Victims of a car accident are often stunned, not just by the impact of the crash, but by the at fault person’s lack of adequate liability insurance coverage. In Louisiana, the minimum liability coverage limits required by law can hardly cover a hospital stay for the average personal injury victim:

- $15,000 of bodily injury coverage per person.

- $30,000 of bodily injury coverage per accident.

- $25,000 of property damage coverage.

Unfortunately, not every car accident will include a at-fault driver with coverage. An at fault driver without coverage can also lead to “hit and run” incidents in which the driver flees after a car accident.

An Insurance Research Institute study found 13.8% of drivers or about 1 in 7 drivers nationwide were uninsured in 2011. Louisiana came in below average at 12.9% of drivers uninsured.

As depressing as these numbers can be for responsible drivers, the personal injury damages one can incur can be curtailed through Uninsured (“UM”) or Underinsured (“UIM”) motorist coverage. In Louisiana, one will have UM/UIM coverage equal to their own liability coverage limits unless the coverage is specifically rejected in writing (or lower UM/UIM limits are requested). Even if your insurance company claims that you do not have UM/UIM, you may want to consider having an attorney check on this issue for you as there are specific requirements in Louisiana regarding the rejection of this coverage.

As depressing as these numbers can be for responsible drivers, the personal injury damages one can incur can be curtailed through Uninsured (“UM”) or Underinsured (“UIM”) motorist coverage. In Louisiana, one will have UM/UIM coverage equal to their own liability coverage limits unless the coverage is specifically rejected in writing (or lower UM/UIM limits are requested). Even if your insurance company claims that you do not have UM/UIM, you may want to consider having an attorney check on this issue for you as there are specific requirements in Louisiana regarding the rejection of this coverage.

UM amounts can include economic and/or non-economic personal injury damages depending upon the coverage selected. Economic damages will be those personal injury damages for medical bills, funerals and lost wages as well as other purely monetary damages. A non-economic personal injury damage will be those for pain, suffering, and mental anguish. Please consider carefully each option before choosing the coverage that best fits your needs.

Finally, while many other states allow the stacking of UM policies within a household, Louisiana does not allow for stacking of UM coverages under La. R.S. 22:1295(1)(c). The only exception to this rule is when the injured party is not occupying a vehicle owned by him/her, a resident spouse, or a resident relative. In that circumstance, the injured party can recover from the car owner’s UM coverage as primary as well as one (1) other UM policy available to him/her as excess.

If you or a loved one has suffered a personal injury, learn about your legal rights from an experienced New Orleans personal injury attorney by filling out our free, no obligation case review form located on this website.

Free Case Evaluation

More About HHK

Other Car Accidents News

When you get into a car, fastening your seat belt […]

After you are involved in an auto accident, it is […]

Throughout the country, speed limits are increasing. From highways to city streets, drivers […]

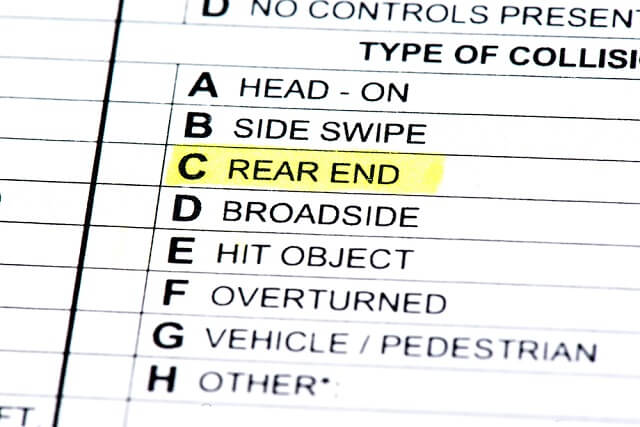

A plaintiff in an automobile accident case can usually count […]

New Orleans, LA Car Accident Compensation Lawyer Car accidents, even […]